Fact: The rules on taxation of consultants changed on 6 April 2021.

But there are a lot of myths out there…….

- Myth 1: ‘I now need to treat all consultants as employees for tax purposes’

- Myth 2: ‘IR35 no longer applies’ OR ‘IR35 now always applies’

- Myth 3: ‘I can rely on the HMRC tool to determine employment status’

This guide aims to bust the myths and give you the simple facts.

What is IR35, and what is the ‘off payroll working rule’?

IR35 is also sometimes known as the ‘off payroll working rules’ and the ‘intermediaries legislation’. The name IR35 is generally used to mean the anti-tax avoidance rules designed to combat ‘disguised employment’ where an individual, who would otherwise be an employee if engaged directly by a client, provides services to a client through the individual’s own intermediary company (sometimes known as a Personal Service Company or PSC).

If the individual is in ‘deemed employment’ then rules apply so that PAYE and NICs must apply to the fees.

What’s changed and what’s not changed for private sector businesses on 6 April 2021?

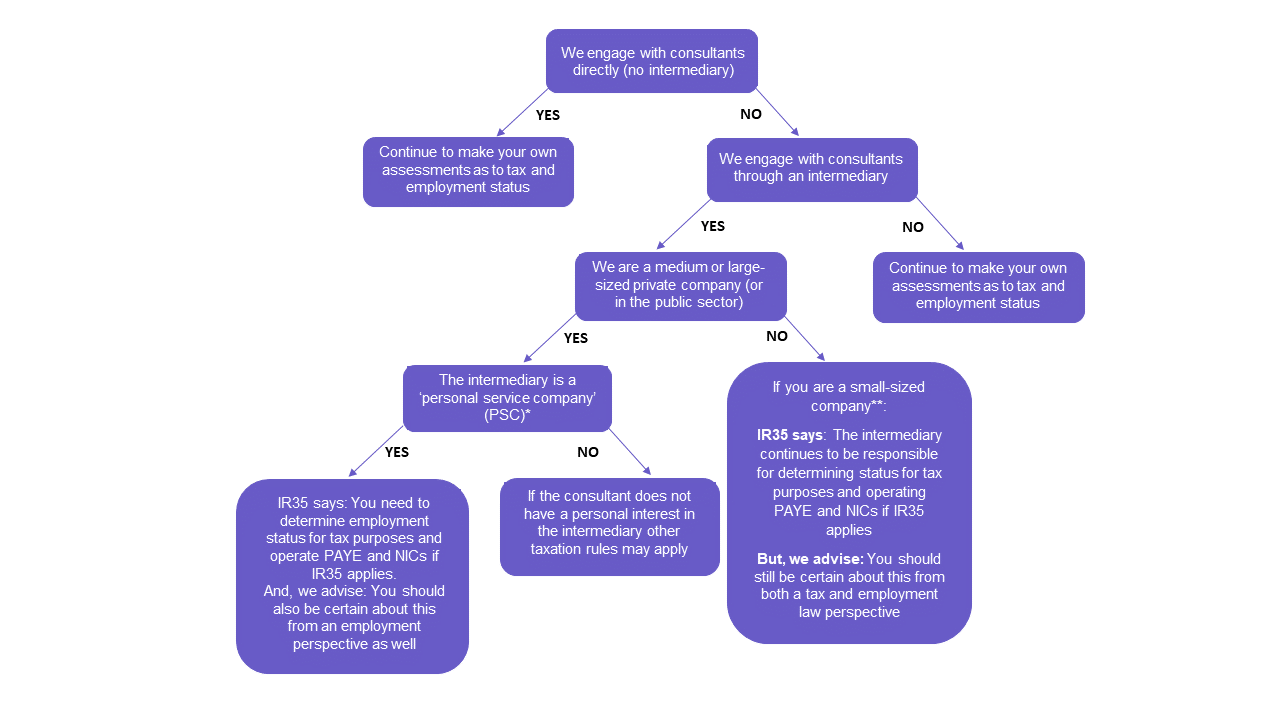

- Genuinely self-employed consultants that you engage directly (not through an intermediary) can continue to be engaged and treated for tax in the same way.

No change. But: Continue to be sure that they are genuinely employed for tax and employment purposes. - Where you engage consultants through an intermediary:

- If you are a small company then the intermediary continues to be responsible for assessing whether IR35 applies, and operating PAYE and NICs if it does.

No change. - If you are a medium or large company if the intermediary is a PSC* the onus of determining whether IR35 applies transfers to you as the client. You are responsible for determining status for tax purposes and for operating PAYE and NICs if it does.

Change (This has been the case for public sector clients, since April 2017.)

- IR35 does not change a consultant’s status for employment purposes, so you should continue to make this assessment for any consultant you engage.

No change.

Use this simple flow chart to help you determine what you need to do next:

* HMRC has confirmed that a PSC will fall within IR35 if either:

- The consultant has a material interest in the PSC (within the meaning of section 61O of ITEPA 2003, meaning, broadly, more than 5% of the ordinary share capital or rights to more than 5% of company distributions or more than 5% of assets on a winding up)

- The consultant has a non-material interest in the PSC but receives payments from the PSC for their services which is not wholly taxed as employment income

** A company is small if it satisfies two or more of the following conditions:

- annual turnover of not more than £10.2 million

- balance sheet of not more than £5.1 million

- not more than 50 employees

(Companies which are not part of a group will be treated as ‘small’ in their first financial year, and until they cease to be so.)

NB:

- HMRC’s tool ‘Check Employment Status for Tax’ or ‘CEST’ can be helpful to determine employment status for tax purposes but is not definitive so should be used with caution

- Tests for employment status for employment purposes can produce different results

The position can be complex so speak to our experts to make sure you have everything in order and all the documents you need in place.